The iGaming industry is bigger than ever—that’s what everyone says. But can emerging operators say the same? Sportsbooks, online slots, and mainstream casino products continue to account for the bulk of gross gaming revenue, but these segments are becoming increasingly saturated.

Established brands are engaged in expensive battles over bonuses, and regulators have become tougher with advertising regulations and increased compliance standards. To most operators, entering these saturated spaces requires high acquisition prices, low margins, and minimal differentiation.

This is where the online gambling business ideas centered on niche opportunities gain strength. Rather than competing over crumbs in saturated markets, operators can seize growth opportunities by tapping into underdeveloped yet highly engaging sectors, such as esports betting, fantasy sports, immersive VR/AR experiences, or culturally specific games.

These niches are not merely side bets—they are strategic moves, tapping into interested communities and changing regulation systems.

The challenge presented to the brands and operators is to combine compliance-first implementation with product focus. Vertical niches typically come with reduced competition, stronger player loyalty, and can be customized to provide more audience-specific experiences.

The future of sustainable iGaming growth in the current environment is not merely about going bigger, but about going smarter by specializing.

The Case for Specialization in Regulated Markets

The controlled iGaming market is still growing, with Europe alone anticipated to account for almost €124 billion in gross gaming revenue in 2024, and such markets as Brazil and Peru are providing new opportunities to licensed operators.

However, despite this development, brands are under increasing pressure.

Here’s why: the traditional benefits of scale are being eroded due to stricter advertising controls, increasing taxes, and the inability of black-market operators to disappear. For many, the standard sportsbook or slot portfolio no longer guarantees sustainable returns.

That is the reason why progressive operators are considering online gambling business ideas that are specific and not general. Niche verticals like esports betting, fantasy games, or culturally oriented games have two strong assets: less competition and greater involvement of the community. Operators can compete on content, product design, and resonance with the audience, rather than competing based on promotions.

This approach is effective in reducing the cost of acquiring customers, as well as maximizing lifetime value by utilizing highly loyal player bases.

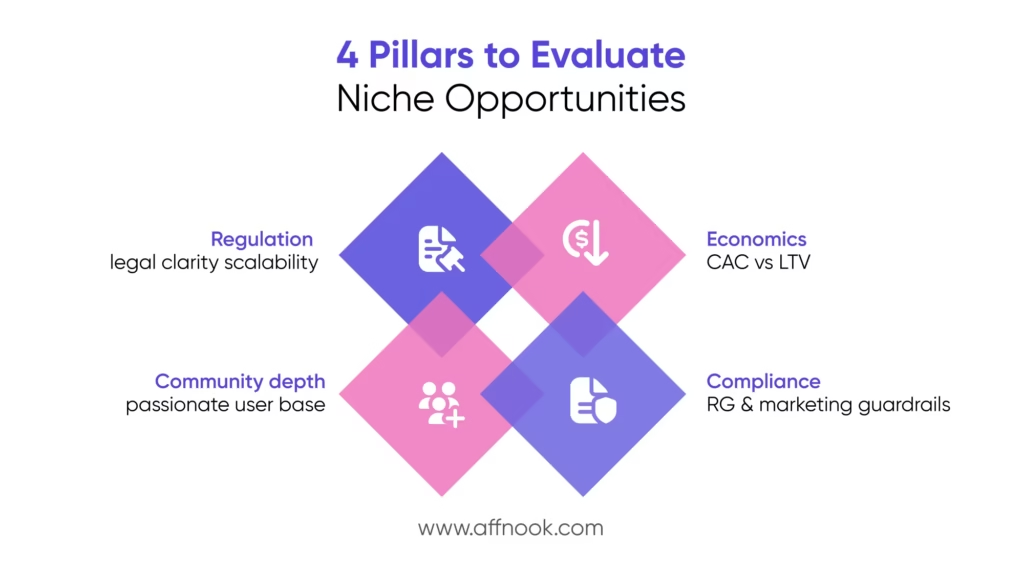

To evaluate these opportunities, operators can use a simple framework:

- Regulation: Is your target market vertical legal and scalable?

- Community depth: Does it appeal to an active, ardent user-base?

- Economics: Are you able to weigh buying price against long-run value?

- Compliance: Do you have responsible gambling and marketing guardrails embedded?

Specialization is not only defensive, it is a proactive means of growing sustainably in controlled markets.

Esports Betting: From Experiment to Core Vertical

Esports is no longer a niche hobby but a multi-billion-dollar entertainment industry, and betting is not far behind. In controlled markets, esports betting is shifting to an add-on status, as opposed to a vertical established status.

To operators looking into online gambling business ideas, this is a segment that provides an opportunity to reach younger and more interested audiences who tend to feel underserved by traditional sportsbook products.

Legalization is slowly catching up. Over a dozen states in the U.S. have legalized esports betting in various forms, and markets such as Colombia are developing legislation that would formally introduce esports as a sport. This operational transparency is opening up room for licensed operators to innovate without fear.

Product design is the actual opportunity. In addition to typical match results, punters want to see interactive features like map plays, first blood in shooters, or propositions based on statistics. In-play and micro-betting are both ideally matched with the quick action of esports, and they provide sticky engagement that prolongs the length of a session.

Go-to-market plans are supposed to be culturally sensitive to gaming communities. Collaborations with streamers, teams, and tournament organizers can become a source of organic acquisition that will be much more resonant than traditional ad campaigns. Nonetheless, operators should also invest in integrity and responsible gambling systems, as esports is attractive among young people.

Properly executed, esports betting is not just a trendy experiment, but a pillar of the future of regulated iGaming development.

Fantasy Sports: Skill-Based Growth Engines

Fantasy sports have evolved beyond hobbyist leagues to become one of the most vibrant online gambling business ideas in licensed markets. In 2024, the fantasy sports industry was estimated to be close to $25 billion worldwide, but it is predicted that its value will exceed that in 2030.

To operators, this is not only a source of revenue but also an opportunity to connect with fans throughout the year with skill-based competition.

Regulatory Advantage

In most jurisdictions, fantasy sports is not considered a game of chance but a game of skill. This difference enables operators to maneuver the regulatory landscapes more freely than traditional betting. As an illustration, fantasy sports are allowed daily in a number of U.S. states where sports betting is limited.

Fantasy cricket has been widely recognized as a skill-based format by courts in India, but federal debates persist. Before launching, it is important to know where your target market draws this line.

Emerging Niches

Diversification is providing the fastest growth:

- Women’s leagues are becoming more visible in the world and finding new pools of fantasy players.

- Local sports like kabaddi in South Asia or volleyball in Europe have unexploited fan bases.

- Flexible casual-player formats offer hybrid models, which combine classic fantasy with pick’em contests.

Monetization Models

Entry fees are not the only revenue. The existence of subscription levels, brand sponsorships, and fan engagement platforms that are based on data generates various revenue streams. Fantasy sports provide growth potential and regulatory resilience to operators looking to scale their online gambling business ideas.

Immersive Futures: VR and AR Gambling Experiences

The most thrilling online gambling business ideas are those where immersive technology is combined with betting. Virtual reality (VR) and augmented reality (AR) are changing the way players enjoy a game, moving it off of flat screens to an interactive, 3D experience.

It is predicted that AR/VR gambling will grow to over $1 billion in the coming years, and a consistent double-digit expansion will follow the increase in device usage.

Use Cases Taking Shape

VR poker rooms and virtual casinos already enable players to sit at realistic tables, communicate with dealers, and socialize with others in real time. AR can take it further by superimposing the digital assets with the real world. Thus, it envisions a betting market on top of a live sports event or a gaming lounge in a retail store. Such innovations do not recreate the casino floor; they are completely new experiences.

Barriers and Considerations

Adoption does not come easy. Penetration is still constrained by the cost of hardware and familiarity, and operators need to make sure that accessibility is available across devices.

More importantly, regulators are starting to think about how conventional rules, such as age verification, responsible gambling instruments, and fair play standards, can be applied in immersive settings. To operators, compliance and player protection must be built into the design process.

To the brands that are not afraid to take risks, VR and AR provide an opportunity to stand out with experiences that no traditional casino would compete with, a new frontier in the history of regulated iGaming.

Localized Games: Cultural Resonance as a Growth Lever

When operators are looking at new online gambling business ideas, few can be as effective as localized and culturally familiar games. The competition in global slot libraries can be replaced by providing formats that players know and believe in.

Latin America’s Lottery and Live-Dealer Appeal

In Latin America, localized instant-win games and live-dealer spins are on the rise. An example is Peru, which is formalizing its regime on remote gaming, and Colombia, which is actively extending the authorization of products such as Keno. Localization of content will result in a higher adoption rate and loyalty compared to generic slot offerings.

Social-First Models in Asia

RNG-based games that are framed as social entertainment are fertile markets, such as Japan and Korea. It is important in terms of mobile-first design and community communication, where players are interested in fun and connection.

The Operator Playbook

Local success in gaming is a scenario that needs regional studio collaboration, acceptance of local payment systems, and localized user experiences. When done correctly, localization is not translation but rather a growth lever that will create authenticity and cost less to acquire.

Growth Markets Spotlight: Brazil, Peru, Colombia & Ontario

Whenever seeking online gambling business ideas, it is as much about the area where regulation is changing most rapidly as it is about the appropriate niche. Brazil, Peru, Colombia, and Ontario are four markets that are both interesting and demanding to operators.

Brazil: The Sleeping Giant Awakens

Law 14,790/2023 has created the foundation of regulated fixed-odds betting in Brazil, and 2025 marks the year in which operational frameworks actually become a reality.

Brazil has one of the largest fan bases globally in football and an increased desire to consume esports, which are enormous opportunities for niche-oriented operators, particularly those who can gain trust due to compliance and localized payment practices.

Peru: Structured and Taxed

In 2024, Peru switched on its remote gaming regime, creating well-defined licensing routes. An excise tax of 1 percent would be an added cost, yet it would have legitimacy and governmental backing. To operators, it translates to predictability and the opportunity to test new products such as fantasy formats or live-dealer products in a controlled setting.

Colombia: A Mature, Esports-Friendly Market

Colombia is one of the most maturely regulated markets in Latin America. Its licensing model is solid, and recent legislation aims to officially establish esports as a sport-laying the groundwork to regulated betting on this rapidly expanding vertical. This renders Colombia the right place to be in when operators want to diversify portfolios with esports and fantasy products.

Ontario: A Compliance Blueprint

The Ontario iGaming market is liberal and highly regulated. Bans on advertising by athletes and influencers, and complex responsible gambling monitoring protocols, have set the threshold of good even more. Ontario can teach lessons to global operators on how to develop sustainable models with strict compliance.

In these markets, the script is simple: pair innovation and local compliance to convert new regulations into profit growth.

Compliance and Integrity as Differentiator

In the current controlled environment, creativity alone does not make or break the online gambling business ideas, but also compliance and trust. With markets getting tough, only those operators who see compliance more as a differentiator than a liability stand a chance of winning.

Integrity in Emerging Verticals

VR betting and esports require robust integrity models. In esports, match-fixing risks or issues of fairness in immersive settings can tarnish player confidence immediately. To protect transparency, operators are advised to invest in official data partnerships and third-party monitoring.

Responsible Gambling by Design

The regulators are increasingly demanding responsible gambling (RG) tools to be designed in. Affordability controls, deposit thresholds, and real-time behavior screening safeguard players and minimize regulatory risk. Integrating them into onboarding and product flows is a show of responsibility and innovation.

Marketing Under Scrutiny

Another compliance frontier is advertising. The athlete and influencer endorsement restrictions in Ontario reflect a global trend, where the promotion of products to vulnerable populations or minors will not be accepted. Operators need to shift to education-based and content-related acquisition strategies that are both legal and ethical.

Building and Scaling a Niche iGaming Strategy

The correct online gambling business ideas are just the beginning. Operators require an organized method of developing, starting, and expanding in regulated markets to turn ideas into lucrative businesses.

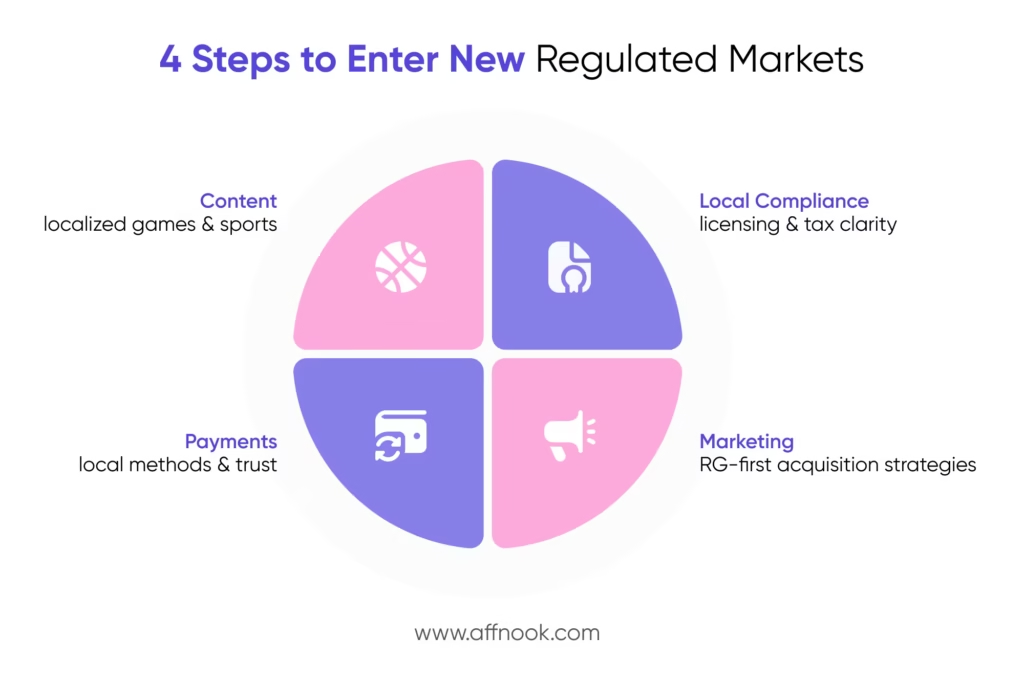

Go-to-Market Playbooks

Every niche needs a specific entry strategy. Esports betting thrives through community collaboration with teams and streamers, whereas fantasy sports can rely on seasonal marketing, based on league calendars.

VR and AR products are typically suited to pilot launches with limited audiences and then rollouts. Localized games require cultural authenticity: regional studios, payment rails, and language-specific interfaces.

Build, Buy, or Partner?

Operators have a strategic dilemma:

- Build: Maximum control and IP creation, but higher upfront cost.

- Buy: Niche platform or studio purchases provide a quick response to the market.

- Partner: Suppliers, affiliates, and tech vendors reduce risk and deliver compliance-ready infrastructure.

Measuring Success

The major metrics go beyond deposits and wagers. Scalability is revealed in customer acquisition cost (CAC), average revenue per paying user (ARPU), and organic first-time depositors (FTDs). The adoption of responsible gambling, such as self-exclusion and limit-setting, is also important in showing compliance strength.

Platforms like Affnook can help operators track these KPIs in real time by centralizing affiliate performance data, automating payouts, and flagging suspicious traffic sources. This level of visibility ensures brands not only grow efficiently but also maintain compliance across regulated markets.

Market Examples

The licensing regime in Peru demonstrates that well-organized compliance can facilitate a high growth rate. Brazil’s 2025 rollout highlights the importance of localized payment integration. Ontario illustrates how stringent ad restrictions demand that operators invest in content-based acquisition, as opposed to bonuses.

Conclusion

The iGaming industry is moving into a new age where size does not necessarily mean success anymore.

To the brands and operators, the way to go is to seek niche online gambling business ideas that resonate with culture, technology, and regulation. Among esports betting, fantasy sports, VR/AR experiences, and localized games, the operators that innovate, embed compliance, and responsible gambling will shine in an increasingly competitive market.

The winning formula is obvious: justify regulatory pathways, be responsible at the core, customize go-to-market strategies to each niche, and discipline track performance. Specialization helps the operators to lower acquisition prices, develop communities of loyal players, and enhance resilience to tight regulation.

Those who increase focus, value opportunities in niche and sustainability have a future in iGaming.

Help Section

1. What are the most profitable niche online gambling business ideas in regulated markets?

Profitable niches include esports betting, daily fantasy sports, skill-based gaming, social casinos, and VR/AR casinos. These verticals attract new audiences, differentiate operators from competitors, and align with evolving player behaviors in regulated markets.

2. How can operators validate new online gambling business ideas before market entry?

Operators should analyze regulatory frameworks, player demographics, market economics, and community demand. Running pilot programs, using affiliate partnerships, and leveraging compliance-ready platforms ensures new concepts are tested effectively before large-scale investment.

3. Why are niche verticals important for scaling online gambling businesses in saturated markets?

Niche verticals reduce reliance on crowded casino or sportsbook offerings. They allow operators to target underserved communities, increase player loyalty, and diversify revenue streams while staying competitive in regulated and often saturated iGaming landscapes.

4. What role does regulation play in choosing online gambling business ideas?

Regulation shapes feasibility, licensing costs, compliance requirements, and market potential. Operators must ensure ideas like esports, peer-to-peer gaming, or new payment models align with jurisdictional rules to avoid penalties and secure long-term growth.

5. How can technology partnerships accelerate niche online gambling business ideas?

Technology partners provide turnkey platforms, compliance tools, and innovative features like AI-driven personalization or blockchain-based payments. These collaborations shorten go-to-market timelines, reduce risk, and help operators quickly scale niche offerings in regulated markets.