Latin America is rapidly emerging as one of the most vibrant growth markets in online gambling in the world, and Brazil and Mexico are its most attractive markets.

The market data show that in 2024, the online-gambling market in Latin America hit more than US$5.3 billion, and it is projected to increase even further at a CAGR of close to 12% till 2030, driven by the adoption of mobile sports betting and casinos.

However, tapping this potential is not as easy as translating your current campaigns into Portuguese or Spanish. Brazil and Mexico are completely different—in terms of regulation and payment patterns, to cultural triggers and favored channels.

In Mexico, both onboarding and engagement are influenced by a history of land-based licensing, high cash usage such as OXXO (an e-wallet app), and local dynamics of trust.

These differences are both a challenge and an opportunity for iGaming operators, networks, and affiliates.

An online gambling marketing strategy that lacks localization will lead to low performance. However, one that considers market-specific behaviors, payment flows, and cultural signals will unlock dramatic growth in engagement in two of the most competitive markets in LATAM.

Why Brazil and Mexico Dominate LATAM Growth

1. High-Value, High-Volume Player Bases (Strengthened by Clearer Regulatory Paths)

With the 2025 regulatory rollout, Brazil is now regarded as the largest regulated betting market in the region, whereas Mexico is one of the most stable markets given its existing licensing ecosystem.

Clearer and well-laid-out regulatory frameworks—Brazil’s new licensing regime and Mexico’s long-standing SEGOB oversight—give operators more predictability, enabling higher investment, faster market entry, and stronger compliance-led campaign performance.

Both markets display high retention rates when operators add local tastes like football-related offers, instant payouts, and community-based interactions.

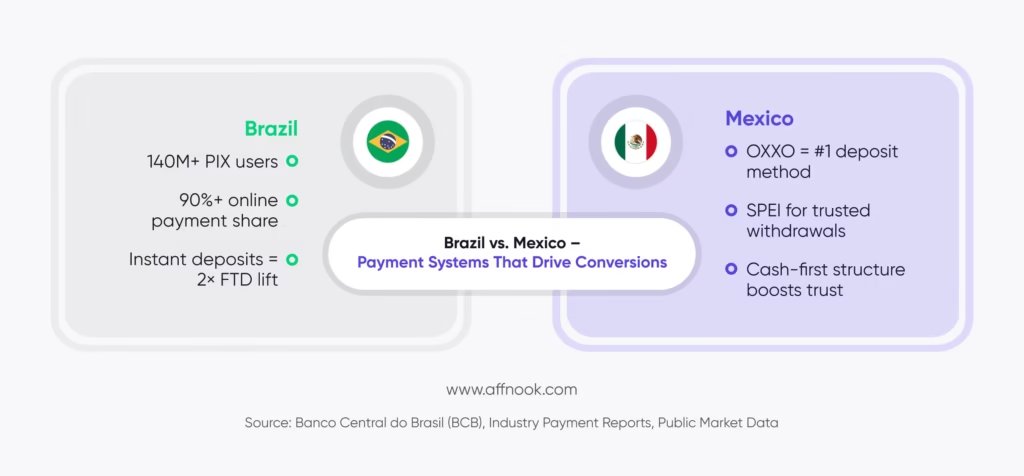

2. Unique Payment Systems That Drive Conversions

The instant-pay system PIX, available in Brazil, has already turned into a conversion engine, with operators regularly doubling first-deposit completion rates when they put PIX in their creatives.

The use of OXXO pay-in vouchers is also necessary in Mexico, where brands indicating the presence of OXXO physically improve deposit trust and FTDs.

3. Cultural Alignment and Higher Engagement

Sports campaigns based on national identities are always more effective than generic creatives.

To illustrate, the Brazilian players experienced significant registration numbers throughout Copa do Brasil tie-ins, with Mexico-centric brands with Liga MX narratives having higher CTRs and lower CPA.

Brazil Deep Dive: Market, Regulation, and Player Behavior

Brazil’s Evolving Regulatory Reality

The iGaming situation in Brazil has changed since 2025, when it became a country that was no longer operating in the grey market, but in a full-fledged licensing environment. The operators have become bound by stringent conditions in the area of advertising, KYC/AML controls, data transparency, and responsible gambling messaging.

To marketing teams, it implies that all campaigns should be compliance-first. Creative should not mean guaranteed victories; influencers need to be vetted, and bonuses should be provided based on some transparent disclosure. The recent trends in enforcement have demonstrated that regulators are not afraid to punish operators in the case of ambiguous claims, unlicensed promo operation, or vague age-restriction communications.

An effective online gambling marketing strategy in Brazil currently strikes a balance between performance interests and airtight regulatory alignment, particularly in relation to influencer content and sport-related promotions.

Player Culture: Football, Fandom, and Real-Time Betting

Football culture has a profound influence on Brazilian bettors. Brasileirão, Copa do Brasil, Libertadores, and European league nights are significant events that cause huge acquisition spikes, with real-time betting taking up most of the traffic.

The snackable content that Brazilian users love is also fast-paced: match-day boosts, micro-markets, and influencer commentary by the football personalities. Local club sponsorship and football-native storytelling by brands such as Betano and Pixbet have shown that brand affinity can be driven to drastic levels compared to generic advertisements.

Live odds updates, short-form video, and event-based push notifications should be used instead of a regular campaign every time.

Payment Habits: PIX as a Conversion Engine

Assuming football draws attention, PIX pushes deposits. PIX is used by more than 140 million Brazilians, and it is the most trusted mode of payment in the country. Immediate deposits and withdrawals will greatly minimize drop-offs, particularly during live matches.

PIX is not merely a payment service to operators, but a conversion optimization tool. PIX-centered CTAs (“Deposite via PIX e jogue em 10 segundos”) can frequently increase FTD and reduce abandonment, particularly in mobile-first users.

Mexico Deep Dive: Market, Regulation, and Player Behavior

A Market Built on Legacy Licensing and Rapid Digital Growth

The iGaming space of Mexico is influenced by SEGOB, which regulates online gambling by granting casino licences and extensions of land-based casinos. This forms a semi-closed ecosystem in which the operators usually enter the market in partnership with local licence holders.

In the case of brands and networks, what is learned is that entry can happen, but you need alliances that are trusted locally, content approvals that are strict, and a marketing strategy that shows credibility on the first day. An effective online gambling marketing strategy should incorporate these regulatory demands without losing agility.

Player Behaviors Driven By Cash Culture and Casino Loyalty

Mexico has a casino-first culture in contrast to the Brazilian football-based betting base. Slots, roulette, and bingo continue to be well-established and particularly among older segments. Nevertheless, the largest behavioral distinction is the cash-based economy of the country: many online bettors continue to use other or prepaid deposits as opposed to the standard card rails.

It is the reason why OXXO, the ubiquitous Mexican network of convenience stores, is a conversion engine. Brands that emphasize deposit at any OXXO around you tend to be more likely to have high first-deposit rates and also lower abandonment upon checkout.

Payments, Language, and Communication Norms Operators Can’t Ignore

OXXO and SPEI are the payment rails that cannot be negotiable, yet transparency is the key to success: Mexicans will want to know the exact dates of withdrawal, are willing to pay to send a message, and are willing to believe that their accounts are safe. There are also issues with language, as campaigns should use Mexican Spanish, not generic LATAM Spanish.

WhatsApp serves as the default communication channel, and operators who use 24/7 WhatsApp support record a higher retention lift than email-based CRM.

In the case of iGaming operators and affiliates, Mexico has been offering rewards to any online gambling marketing strategy that focuses on trust, clarity, and cash-friendly UX.

Cultural and Language Nuances That Shape Creative and Messaging

Understanding Portuguese vs. Spanish Nuance

At a glance, Brazilian Portuguese and Mexican Spanish could be similar, yet in marketing communication, they are like completely different engines. Brazilian customers respond positively to warm and conversational voice, local dialects, as well as football-related expressions embedded into your creative.

In Mexico, clarity and straightforwardness would be more effective. Brief and assertive lines and localized phrases make people trust; this would especially be effective in performance-based campaigns. This micro-localization can be the difference between bouncing and high engagement with brands that are shaping an online gambling marketing strategy.

Local Cues That Boost Relevance

Hyper-local treatment is also required in visual identity. Bold colors, club badges, and carnival-inspired energy attract attention easily in Brazil. Culturally based motifs, such as Liga MX team colors, festival-based palettes (or even OXXO-based indicators of trust), are better in Mexico in terms of relevance and click-through.

Creatives in both markets are frequently built around national occasions: Derbies, Clasicos, Carnival, Día de los Muertos, or World Cup qualifiers.

Compliance Messaging That Still Converts

In both countries, regulators would like to see the responsible gambling messaging, but the location is the issue. By ensuring that disclaimers are brief, above the fold, and in a non-obtrusive place, trust is not violated, and conversions do not suffer.

A Simple Localization Checklist

- Local currency (BRL / MXN)

- Market-specific slang

- Holiday/event-aligned creatives

- Payment-tied CTAs (PIX / OXXO)

- Regional formatting (dates, decimals, time zones)

These cultural and language layers are not superficial; they have a direct impact on conversion quality, trust, and retention in the long term amongst the leading gaming markets in LATAM.

Payments and Onboarding: Optimizing Conversion in Local Context

Local Payment Rails Drive Conversions

Players do not convert until they see their favorite rails in Brazil and Mexico. PIX serves more than 90% of online payments in Brazil, and any serious online gambling marketing strategy must include it. OXXO and SPEI reign in Mexico since gamers prefer cash and bank-transfer payments that are safe and familiar.

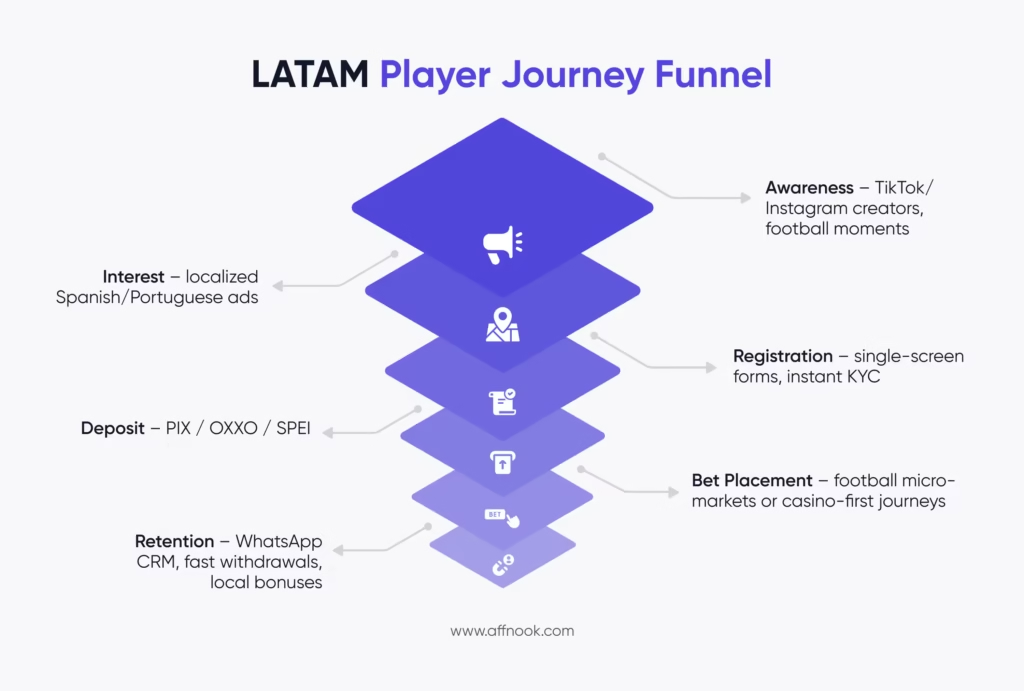

Frictionless Onboarding Wins First Deposits

LATAM players want quick subscriptions. Single-screen registration, automatic ID checks, and real-time deposit confirmations are a great boost in FTD rates. Simplified KYC flows report lower abandonment on high-intent traffic compared to operators with traditional KYC flows.

Build Trust Through Payment Clarity

Clearly defined deposit limits, withdrawal processing, and conspicuous local support systems help eliminate doubts, particularly in the cash-intensive markets of Mexico. Bright microcopy (PIX credited instantly, OXXO slip valid for 48h) keeps players on their toes.

Local UX Prevents Drop-Offs

Localisation of UX to payment journeys in each country, Brazil PIX instant screens, or Mexico store-voucher countdowns, eliminates unease and increases retention at the initial stage.

Channels and Tactics: Building Localized Campaigns

Prioritizing High-Impact Acquisition Channels

Brazil and Mexico are highly receptive to graphic, personality-based content. Instagram, YouTube, and TikTok continue to cash in, particularly during football moments and trendy creators. Search also bridges both markets, with branded terms often providing some of the greatest intent to operators.

In any online gambling marketing strategy, a combination of search intent and culturally sensitive video content generates a potent funnel to LATAM acquisition.

Influencers Who Drive Real Conversions

Trust can be built immediately by sports commentators, football influencers, and gaming streamers. In Brazil, the campaigns that collaborate with mid-tier creators tend to do better than celebrity endorsements since audiences prefer authenticity.

Pixbet achieved rapid national visibility in Brazil through aggressive collaborations with football influencers, club sponsorships (including Flamengo & Vasco da Gama), and continuous match-day commentary content.

Their strategy centered on authenticity: instead of celebrity hype, Pixbet used creators embedded in football culture. This resulted in high trust, strong CTRs, and massive brand recall during national derbies.

Paid Media, Programmatic, and CRM Touchpoints

Event-based geo-targeted programmatic buys, such as Liga MX or Brasileirão matches, always give uplift, particularly when combined with custom onboarding experiences such as PIX-first or OXXO-first flows.

WhatsApp is a must-have to retain in Mexico, and Brazil is highly receptive to push messages and SMS with clear value propositions, such as cashback, increased odds, or instant-withdrawal reminders. Long-term involvement is further nurtured through loyalty programs based on local rewards (BRL/MXN bonuses, club-related benefits).

Solutions like Affnook offer affiliates and networks real-time analytics, enabling operators to gauge ROI in the intricate digital environment of LATAM and tailor their approach to online gambling.

Campaign Design Playbook: Creative, Offers, and Tracking

Segment Your Players Smartly

Successful campaigns in LATAM begin with proper segmentation. Differentiate between high-frequency sports bettors and casual casino players and distinguish high-value users at an early stage based on deposit pattern and bet slip size. This will enable operators to craft an online gambling marketing strategy that resonates with the motivation of each group.

Localised Offers That Actually Convert

Free bets on match-day in Brasileirão, minor risk, first bet insurance, and PIX/OXXO-based deposit promotions are always more effective than generic promotions. Operators providing PIX-based instant cashback have experienced a double-digit increase in first-time deposit rates in Brazil, and holiday-related promotions (Carnaval, Dia de Muertos) have been highly reactivating in Mexico.

Creative That Feels Native

Include localized headlines, football-focused images, and payment-related CTAs such as “Deposit via PIX in Seconds.” Video content (short-form) is particularly successful when associated with reality (goals, VAR decisions, derby games).

Track, Attribute, and Stay Compliant

Embracing server-side monitoring is also important because cookies are becoming less efficient, and ad networks are becoming more restrictive. Combine this with fraud-detection triggers in the high-risk settings at LATAM. All the assets must be in compliance with the local regulations, such as disclaimers, age labeling, and free of deceptive win messages.

Proven LATAM Playbooks: What Successful Campaigns Get Right

Brazil: Football and Influencers That Actually Convert

The most successful campaigns in Brazil still rely on the football culture. The most notable example is the Betano-style model that is implemented at big clubs: operators combine match-day boost with influencer watch-along livestreams. These activations are always better than ordinary advertisements since they combine live emotion with credible faces.

Betano’s campaigns included club-branded promotions, instant-bet boosters, and influencer match-reaction content—strategies that earned a sharp rise in traffic during game windows and boosted active bettor numbers across major fixtures.

Mexico: OXXO-First Journeys That Remove Friction

In Mexico, the most successful operators are concentrated on the ease of payment. Redesigned onboarding based on the concept of OXXO-first deposits, where users were presented with an already scanned voucher within a few seconds, and experienced a radical difference.

As Mexico’s leading sportsbook, Caliente.mx generated record acquisition spikes through Liga MX partnerships involving in-stadium branding, team-specific promotions, and interactive match-day challenges.

Caliente matched team-based narratives with targeted social ads and exclusive bonuses for fans betting on their own clubs—a hyper-localized strategy that boosted registrations and positioned the brand as the default sportsbook for football bettors.

Best Practices and Launch Checklist

Prioritize Compliance From Day One

In the post-2025 Brazilian framework, the regulators of LATAM are tightening their oversight. Make sure that all creative approvals, claim approvals, bonus mechanisms, and influencer partnerships are approved in advance. An online gambling marketing strategy that is compliant ensures long-term scalability and avoids expensive discontinuities.

Localize Payments and UX

In Brazil and Mexico, conversion relies greatly on trusted rails. Start using PIX in Brazil, OXXO and SPEi in Mexico, and feature them on landing pages and creatives. FTDs increase a lot with fast KYC and local currencies, as well as transparent withdrawal messages.

Vet Influencers and Creatives Carefully

Only collaborate with creators who are highly credible in sports or gaming. Brazil has practiced enforcement measures concerning non-compliant influencer posts, and therefore vet contracts, scripts, and disclaimers.

Prepare with a Regional Playbook

Pre-launch: Have translations, age-verification flows, sports-event calendars, CRM templates, and CX support ready. The winning teams in LATAM are teams that start with a structure, not improvisation.

Conclusion

The growth potential of iGaming brands, operators, and networks in Latin America is enormous, yet success will depend on navigating through its complexities. Brazil and Mexico, specifically, require a localized online gambling marketing strategy that would accommodate rules and regulations, cultural sensitivity, and flows of user experiences.

Operators who do this by matching the strategy to Brazil’s PIX-based payments and player-focused advocacy campaigns, the OXXO cash flows, and trusted communication in Spanish, will achieve a much greater level of engagement and retention.

In the case of operators who are willing to ride on the iGaming boom in LATAM, a marketing strategy is no longer optional, but a necessity.

Help Centre

1. What is the Most Effective Online Gambling Marketing Strategy for Brazil’s Regulated Market?

The strongest approach combines compliance-first ads, PIX-focused payment messaging, football-centric creatives, and mid-tier influencer campaigns. Brands that localize language, club culture, and deposit flows see significantly higher CTR, FTDs, and retention.

2. How Can Operators Improve Conversions in Mexico’s Online Casino Market?

Integrating OXXO-first deposit journeys, simplifying onboarding, and using Mexican-Spanish creatives drives trust and FTD lift. Clear withdrawal timelines and WhatsApp-based support significantly boost engagement in Mexico’s cash-heavy player environment.

3. Why do Payment Methods Matter in a LATAM Online Gambling Marketing Strategy?

In LATAM, payment rails are conversion levers. PIX drives instant deposits in Brazil, while OXXO and SPEI build trust in Mexico. Highlighting these methods in creatives consistently reduces abandonment and increases first-deposit rates.

4. What Type of Influencers Work Best for iGaming Campaigns in Brazil and Mexico?

Brazil performs best with mid-tier football creators and real-time match commentators. Mexico responds strongly to regional micro-influencers in casino or sports niches, especially those who emphasize credibility and trust-first messaging.

5. How Can iGaming Brands Localize Creatives for Higher Engagement in LATAM?

Use country-specific slang, culturally aligned visuals, and event-based narratives (Liga MX, Brasileirão, Carnival). Tailoring CTAs to payment habits—PIX in Brazil, OXXO in Mexico—helps ads feel native and boosts conversion quality.